Filing a tax return in japan

Filing a

tax return in Japan is compulsory if you are self-employed in Japan. This

article is intended for those who work part-time at various companies or have

work on the side, and it is your first time to file a tax return in Japan. If

you are employed full-time then there is no need to file a tax return. Your

company will do everything for you.

You could also file your taxes online at https://www.e-tax.nta.go.jp/en/index.html but the forms are all in Japanese and if it’s your first time, you could easily make mistakes. I would recommend going to the tax office in person. If you have all the necessary documents and information, you should be able to have everything done within 2 hours.

why should you file a tax return in japan?

Well, for one, it is required by law, and two, you could be entitled to some money back! Yes, that’s right. You might have paid too much tax and therefore get some cash back. For me, I was pleasantly surprised when I filed my tax return for my first year of being “self-employed” to get a tax refund of over 50,000 yen! So, it is definitely worth doing.

The great

thing about filing your tax return in Japan is that if you take all the necessary

documents to the tax office, they will do everything for you. I was so

surprised at how helpful they were. You do need to speak a bit of Japanese as

the staff speak little to no English, so do a little studying of some useful

tax vocabulary beforehand. Also, it’s perfectly acceptable to whip out your

phone and use Google Translate if necessary.

required items

The documents you will need to take to the tax office are:

- Your pension book. You should also have received a letter detailing your pension contributions which you should take.

- Health insurance proof of payments. You should have received a letter detailing this.

- All of your end of year tax slips (gensenchoushuuhyou 源泉徴収票) from each of your salaried jobs.

- My Number card, if you have one. If you don’t have a My Number card then you would have to present a notification card of the individual number or a copy of your resident register.

- Resident card/driver’s license/passport.

- Hanko (personal seal)

In addition to the above you also need to do a little preparation before you go.

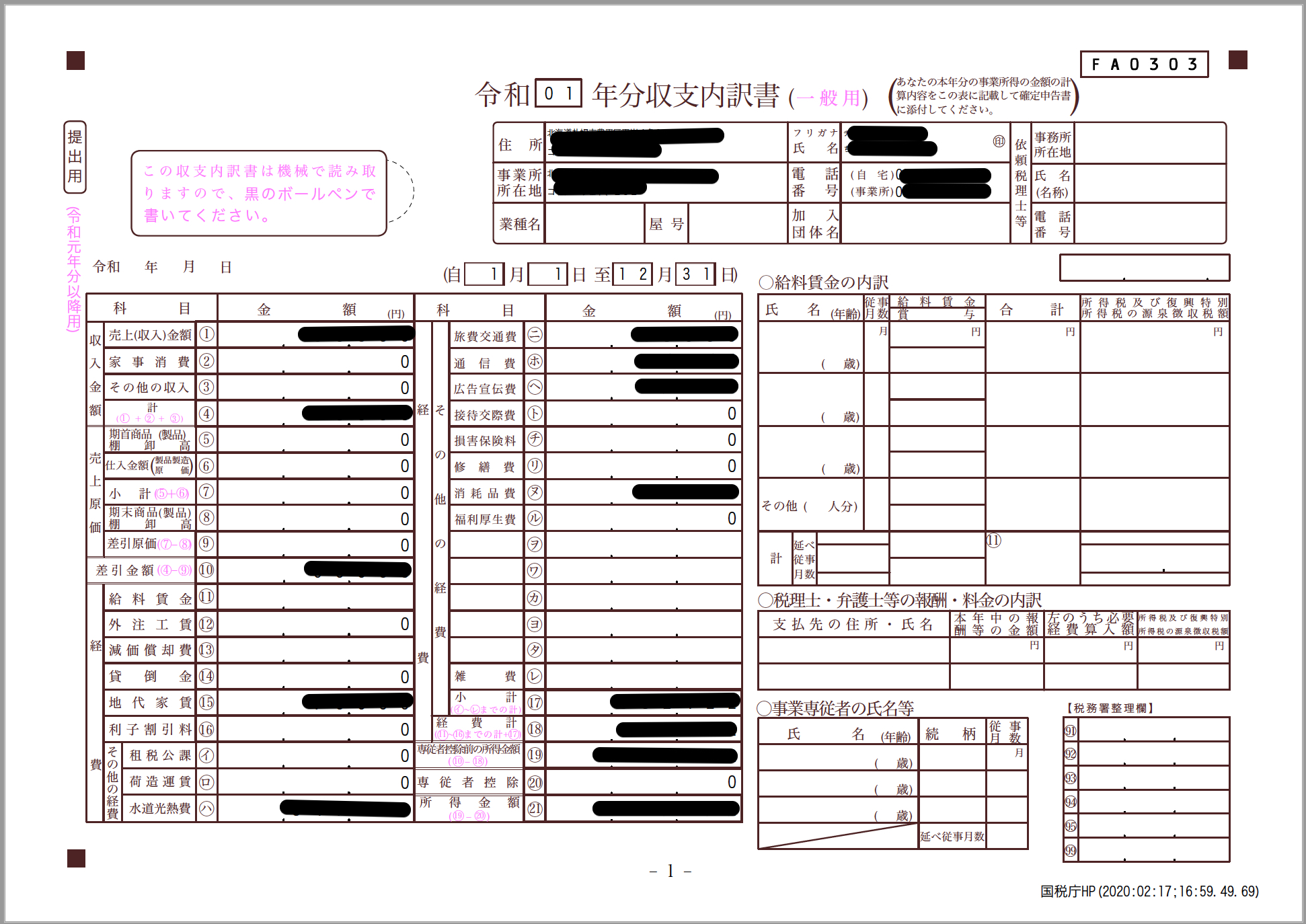

The first thing you need to do when you are self-employed is to get a “Statement of earnings and expenses” (収支内訳書 shushiuchiwakesho). This is for your income from other jobs and side projects that haven’t had tax deducted. This DOES NOT include jobs where the companies have deducted tax from your pay, or the jobs that you have a gensenchoushuuhyou (源泉徴収票).

“Statement of earnings and expenses” (収支内訳書 shushiuchiwakesho)

You can get

this form from your tax office, but you don’t really need to complete this before you go, as

the staff at the tax office will help you. However, you do need to prepare some

information to help you fill it in. It seems daunting, but you don’t need to fill in every field to file a tax return in Japan. The

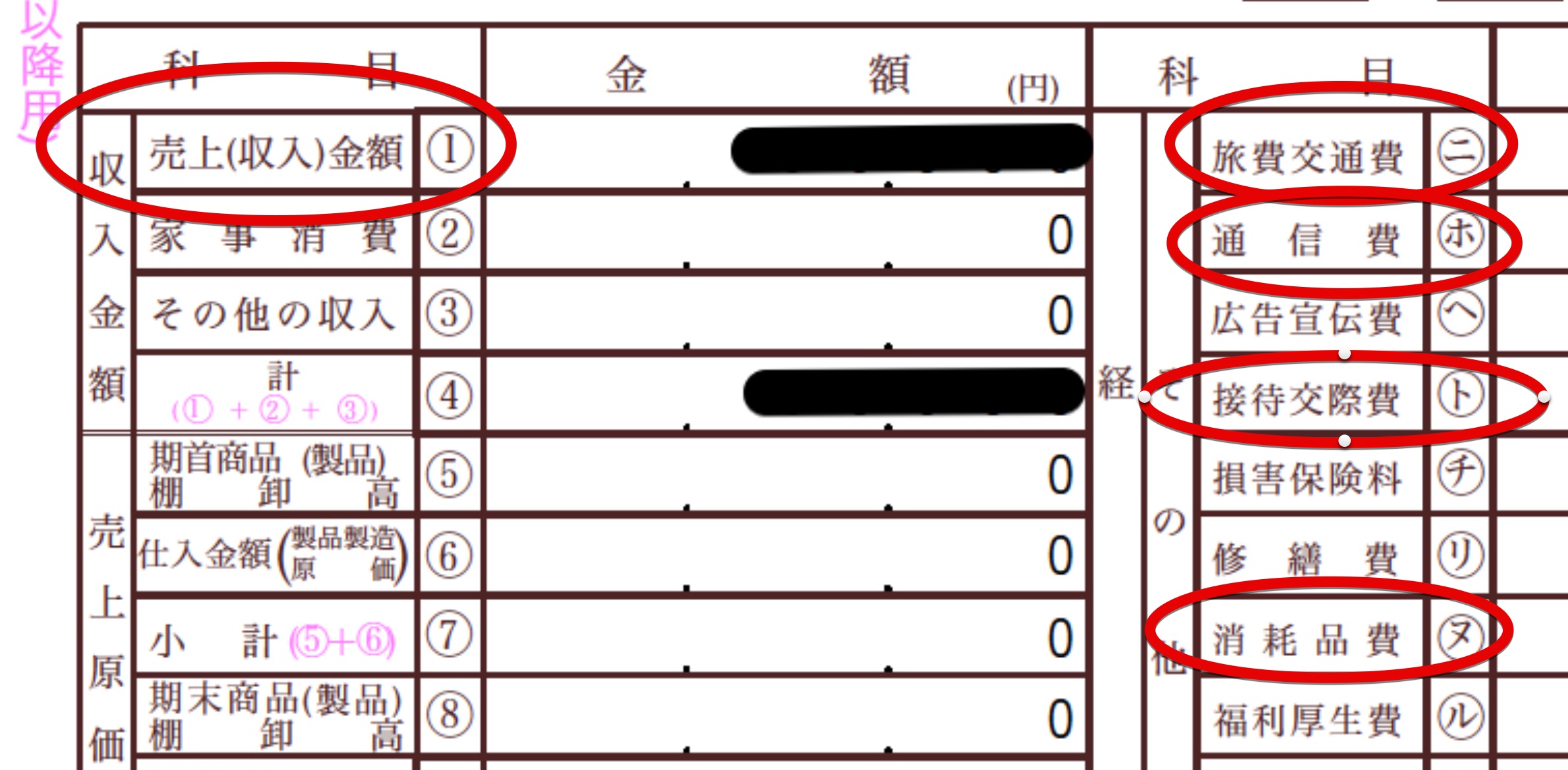

important fields are circled in red below.

- Sales 売上(収入)金額. This is the total amount of income you have made from your private jobs, side gigs, etc.

- 旅費交通費 (ryohikoutsuuhi). This is your travelling expenses for the year. You can also add the cost of vehicles that you have bought during that year that you have used to commute to your side jobs.

- 通信費 (tsushinhi). This is your communication expenses such as your phone bill. You will be asked to estimate the usage for your self-employed work as a percentage. The tax staff will then calculate the number for you.

- 接待交際費 (settaikousaihi). This is entertainment expenses. You can enter things here such as food or drinks that you have consumed during your self-employed work.

- 消耗品費 (shoumouhinhi). Consumerable goods or office supplies. This can be anything that you have bought that was used to assist you in your self-employed work. It’s a good idea to produce a spreadsheet detailing all the costs. I actually took a spread sheet and, together with the tax advisor, went through each item and discussed which ones could or could not be expensed. This probably requires the most amount of work as you need to keep a record and the receipts throughout the year.

These are the main things that you need to consider when being self-employed, so it is a good idea to keep receipts for everything. I actually wasn't asked to present any receipts, but it is always a good idea to have them just in case.

Now, that you have all the documents and items mentioned above, and the numbers necessary to complete the Statement of Earnings and Expenses, head down to your local tax office. There will be a lot of people there so aim to go early. It should take no longer than 2 hours depending on the number of people waiting.

If it’s your first time to file a tax return in Japan or you can't remember how, tell the staff that you would like to have a consultation (Soudan) and you will be taken to a small room where you can have a one on one consultation with a tax advisor. They will help you complete the Statement of Earnings and Expenses and then guide you through the remainder of the process. It really is truly astounding at how kind and helpful everyone is. Just remember to learn some of the tax vocabulary you may need, especially the ones mentioned in this article, and you will be fine. And, if you are lucky you may get a nice little payout!